¿Deseando viajar a Potrero de los Funes? Nosotros te recomendamos sin lugar a dudas alojarte en una de las cabañas en Potrero de los Funesy disfrutar al máximo de la estancia. ¡Hay una gran variedad de opciones a elegir!

Las mejores cabañas para alquilar en Potrero de los Funes

Cabaña en la Sierra

Cabañas Brisa del Lago

Cabañas de Tronco Silvestre

Cabañas del Duende

Cabañas del Fuego

Cabañas Espejo del Cielo

Cabañas Estacion Potrero

Cabañas Kiyari

Cabañas La Barranquita

Cabañas Las Mercedes

Cabañas Lujan

Cabañas Samir

Complejo del Mirador

La Encantada

Las Encinas

Preguntas sobre cabañas en Potrero de los Funes

La localidad de Potrero de los Funes pertenece a la provincia de San Luis, en el extremo noreste del departamento Juan Martín de Pueyrredón. Es reconocido por la gran belleza natural que ofrece y por albergar el circuito de Potrero de los Funes, el cual fue incluido en varios campeonatos tanto nacionales como internacionales.

El pueblo está ubicado a 23 km al noreste de la ciudad de San Luis, para un viaje de alrededor de 30 minutos entre ambos por la Ruta Provincial 18. A lo largo del camino puede disfrutar del paisaje escénico de la provincia.

Al estar ubicado en el valle que crean las Sierras de San Luis, está rodeado por cerros y zonas naturales. Además, al estar a una altura de 940 m.s.n.m, cuenta con un micro clima excelente durante todo el año. Por esta razón, a pesar de ser un poblado pequeño, resulta ser uno de los destinos turísticos más populares de todo el aglomerado urbano de Gran San Luis.

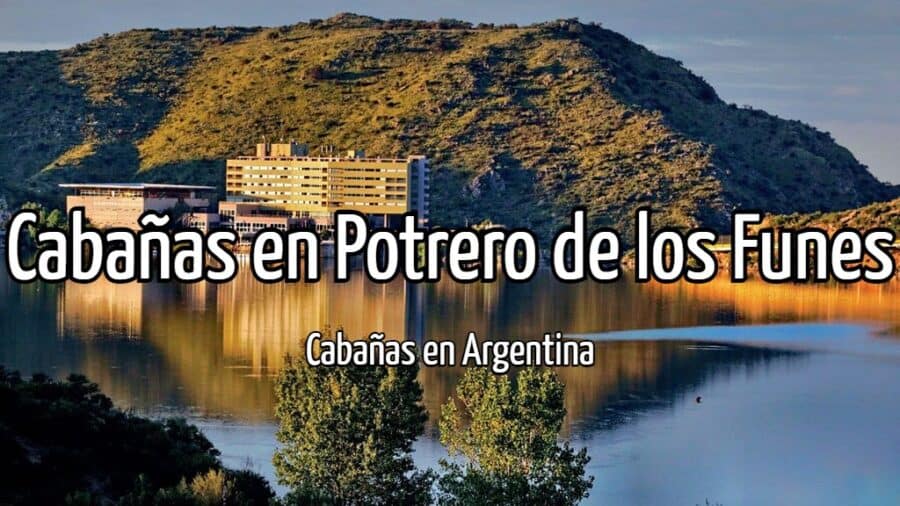

Entre las principales atracciones que tiene Potrero de los Funes, está la práctica de deportes náuticos en el lago del mismo nombre que se encuentra al sur. En este mismo lago está uno de los hoteles más famosos, que lleva el mismo nombre del pueblo. Además, alrededor del lago, se traza el mundialmente conocido circuito de carreras.

También es popular realizar caminatas y escaladas a los varios cerros que hay alrededor del pueblo, ya que la abundante flora y fauna ofrecen paisajes excelentes y una gran experiencia en la naturaleza.

Tampoco se puede olvidar la cultura del pueblo en sí misma, pues dentro no solo hay una gran variedad de restaurantes y hospedajes dedicados al turismo, sino que, si visita durante la temporada de verano, puede disfrutar del festival folclórico El Fogón y el Lago, donde se presentan músicos tanto regionales como nacionales, así como los campeonatos de carreras TC 2000.

- Conducir por la Travesía de las cumbres – Uno de los paseos más recomendados, siendo una ruta asfaltada de 11 km que une a Potrero de Fuentes con la ciudad de La Punta que pasa por las sierras de San Luis. Puede apreciar el bello paisaje y, si lo desea, detenerse en el mirador en el punto más alto de la ruta, para tener una mejor vista.

- Escalar por la quebrada de los Cóndores – Antes de llegar al pueblo, puede verse la garganta creada por las paredes de granito de 350 metros. Este lugar es ideal para los que desean ver las aves, como los halcones y cóndores que anidan en él, y para los que desean practicar montañismo.

- Paseos por el Parque Nativo – En la intersección entre la Av. Del Circuito y el cruce a El Volcán, está el parque, conformado por 7 hectáreas de faldeo cubiertas por vegetación nativa y vista al lago. Al tener entrada libre, puede disfrutar de parrilladas en los nichos, practicar deportes náuticos o paseos con toda comodidad.

- Deportes en el Lago Potrero de los Funes – El principal punto de interés de la localidad es el embalse, en el cual se puede practicar windsurf, kayak y pesca deportiva de carpas y pejerreyes.

- Visitar en el Hotel Potrero de Funes – Siguiendo en la zona del embalse, debe hacer una visita al hotel Potrero de Funes, para lo que no necesita ser huésped. Este se encuentra a las orillas del lago, desde donde se puede ver el pueblo y disfrutar de las comodidades del hotel.

- Parque Nacional Sierra de las Quijadas – Una de las vistas que no puede perderse en esta región es la del cañón que se encuentra en el Parque Nacional, pues ofrece vistas impresionantes y un excelente lugar para dar caminatas. Para llegar a este debe tomar por la ruta 147.

- Trekking en el Salto de la Moneda – La mejor ruta para el trekking, es la que lleva al Salto de la Moneda, pues es sencillo y lleva a una caída de 10 metros entre la sierra con dos piletas. Para este hay varias visitas guiadas que parten desde el pueblo.

- Una vuelta por la Capilla de San Antonio – Uno de los lugares culturales que visitar dentro del pueblo es la capilla, que data de 1957 y se encuentra en el centro cívico del pueblo. Aunque no es una gran obra arquitectónica, si es un área muy bonita que vale la pena visitar.

- Excursión por el Cerro Retana – Para los amantes del trekking y el montañismo, entonces puede escalar el cerro Rentara, uno de los más altos de la sierra, con 2152 metros. El camino le lleva por arroyos y varios montes, y aunque puede tomar todo un día, se puede hacer a caballo.

Gracias al buen clima, los excelentes hospedajes y las muchas actividades, se puede viajar al pueblo en cualquier época del año. Sin embargo, si desea evitar la temporada alta y obtener mejores precios, entonces se recomienda evitar ir durante el verano, aunque se perderá de los festivales y las competencias de carreras.